M&G Wealth shares their Wealth Report, as part of Tenet Compliance Services Professional Development Programme.

At a time when financial pressures are increasing and money is high up the news agenda, a growing number of families and couples are hiding from financial discussions with one another, finds new M&G Wealth research.

M&G Wealth’s Family Wealth Unlocked report, looks at the financial habits of 2,000 UK adults who personally use, or have a family member who uses, a financial adviser. According to the report, long-term finances could be impacted by a contraction in conversations today, with the research finding that individuals are not planning ahead and could be missing out on finding financial solutions.

Cost of living hits family openness around finances

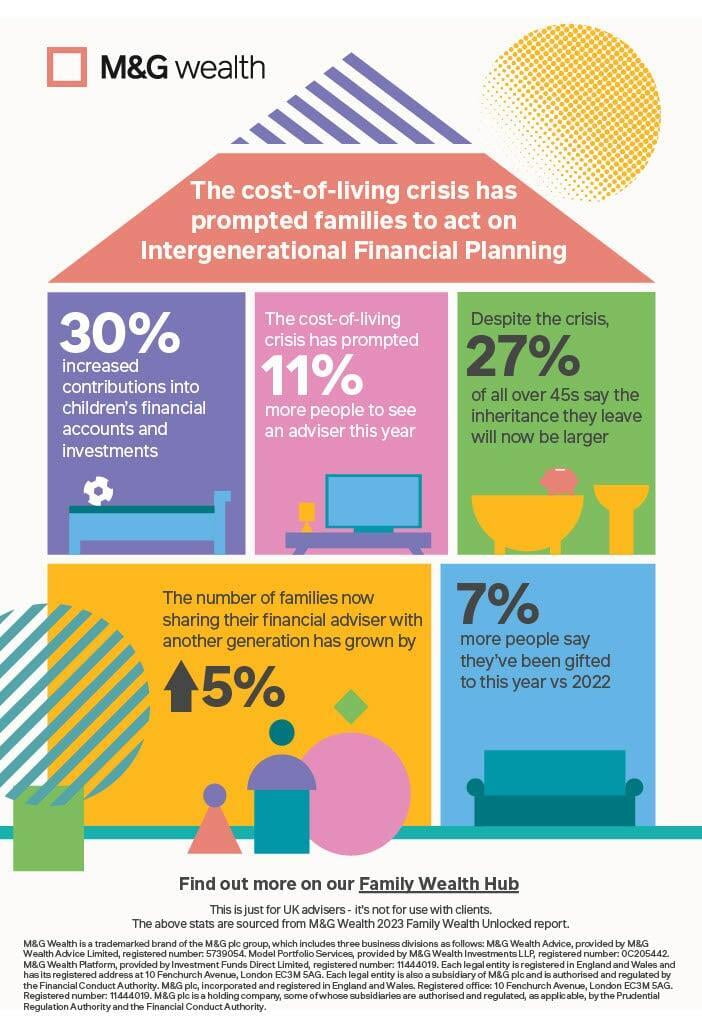

The ‘Family Wealth Unlocked’ report finds that there’s been an increase in the number of people not wanting to discuss finances since the start of the cost-of-living crisis and are hiding worries or money from their loved ones. Key findings from the report include:

- A fifth (20%) of adults which use a financial adviser are hiding their finances from their family, while one in five (19%) now say they’re too embarrassed to discuss their finances, up from 14% in 2022.

- Only half (49%) of respondents in a couple talk openly about their finances with their partner, a huge drop from 69% who said they did so in 2022. Almost a quarter (23%) said they wouldn’t discuss their finances with anyone in their family

- In fact, respondents are more likely to seek advice from financial websites (21%) or online search engines (18%) than from their partner (15%) or parents (13%)

- This comes as a fifth (21%) of people surveyed worry about having to support their family financially on a daily basis, with 11% worrying about this “multiple times per day”

- Nearly four in ten people surveyed (37%) have reduced savings and investments contributions because of the cost-of-living crisis, with an additional quarter (27%) also looking to do so before May 2024

Kirsty Anderson, savings expert at M&G Wealth, commented: “Discussions about money have always varied between families, but our research suggests that openness between generations is taking a hit in this current cost-of-living crisis. In an environment when everyone is feeling the pressure, it is important that conversations about money start at home. Now is not the time to shy away from discussions or hide financial issues, as speaking about problems and being honest with family members can provide the extra mental and emotional support people might need, as well as helping them to create a financial plan.

“Our data shows an increase in the amount of family gifting between generations, with older family members less likely to wait to pass on money through inheritances. Gifting can work out as a tax efficient measure to help younger family members deal with life events or daily financial challenges, from buying a house or paying for a wedding, to just to helping them to manage their day-to-day bills. Encouraging conversations at home about financial affairs, or seeking professional financial advice, could help to unlock solutions for those struggling.

“The research shows that financial advisers are in a good position to facilitate these conversations within families, as a growing number of people are now sharing their adviser with other family members. Individuals benefit from the knowledge of the family’s financial affairs, while enabling them to better prepare for the future from a more informed point of view.”

Inheritance Impacts

Family communication is particularly crucial for those expecting to inherit funds from their relatives. For those planning ahead or in need of immediate funds, families are starting to look more at gifting as a tax-effective option to help loved ones. Three quarters (75%) of respondents have received some money from parents for a life event or to support with ongoing costs, while 56% have received money from grandparents. The number of people who said they’d received no gifts has decreased from 23% to 16% year on year.

Some of the most popular items being gifted from parents include money for a wedding (14%), money for a house deposit (12%), to help with bills (12%) and 11% who say their parents have gifted them money for their savings and investments.

With freezes to the inheritance tax (IHT) threshold and the research showing that a greater number of people are planning to leave inheritances due to the cost-of-living crisis, the number of people falling into paying IHT is ticking up, with an additional £1bn being claimed by the Treasury this year.

However, the report shows that nearly three in ten (27%) of those individuals which are due to inherit from their parents are yet to plan for it, meaning that their unpreparedness could potentially cause them to miss out on tax efficiencies and to not maximise their capital.

The cost-of-living crisis has impacted many people's planned inheritances – for both better and worse. The amount of inheritance that respondents are expecting to receive has increased for over a third of respondents (34%). One in ten (13%), however, think they will be receiving less than they had previously expected.